A new study by Droid Mobile Consultancy found the public to be split on their attitudes to cryptocurrencies such as Bitcoin, and on the use of blockchain technology.

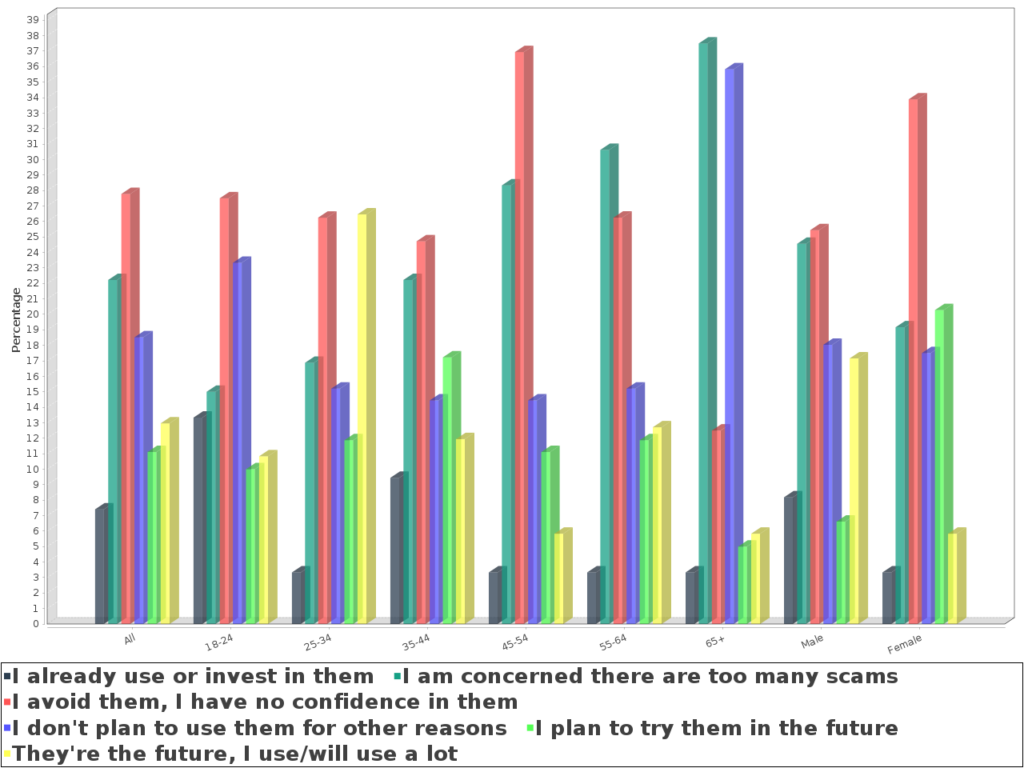

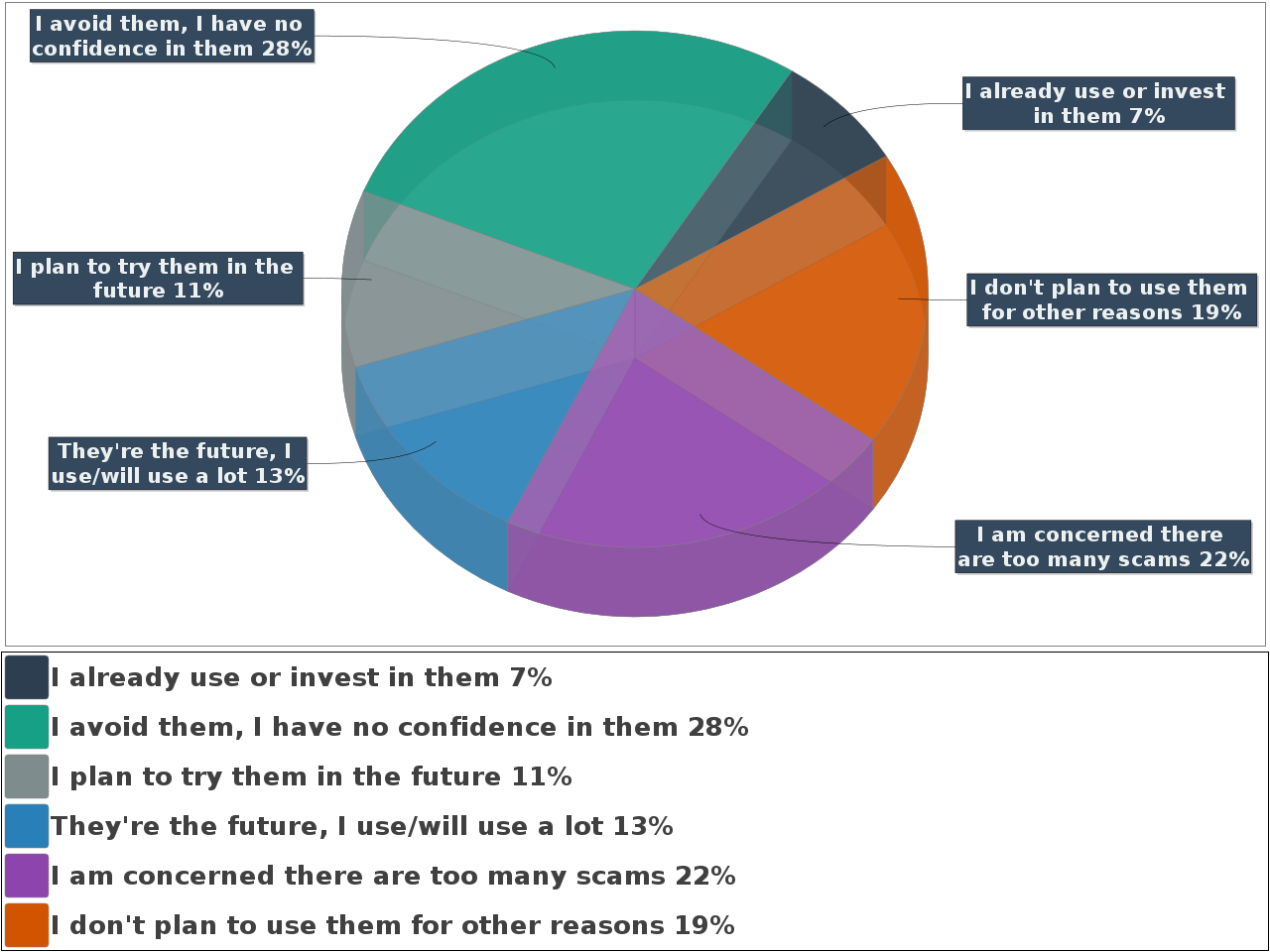

A new study by Droid Mobile Consultancy found the public to be split on their attitudes to cryptocurrencies such as Bitcoin, and on the use of blockchain technology. A significant number of those surveyed (28%) said they had no confidence in the technology and avoided it, this reflects the negative view of some commentators. Investment legends Charlie Monger and Warren Buffet among the most vocal critics with Buffet once describing Bitcoin as ‘probably rat poison squared’.

22% stated that they were too concerned about being caught up in some of the outright scams that have been increasingly targetted at the cryptocurrency space. Many of these are aimed at investors who have a limited understanding of the technology and market, often those who want to get involved for the first time. These include the recent NFT scams, and the OneCoin fiasco described by The Times as "one of the biggest scams in history". There have also been very notable instances of the theft of investor’s currency from exchanges, such as happened with Mt Gox. In 2018 alone, there were over $1.7 billion worth of cryptocurrency related scams.

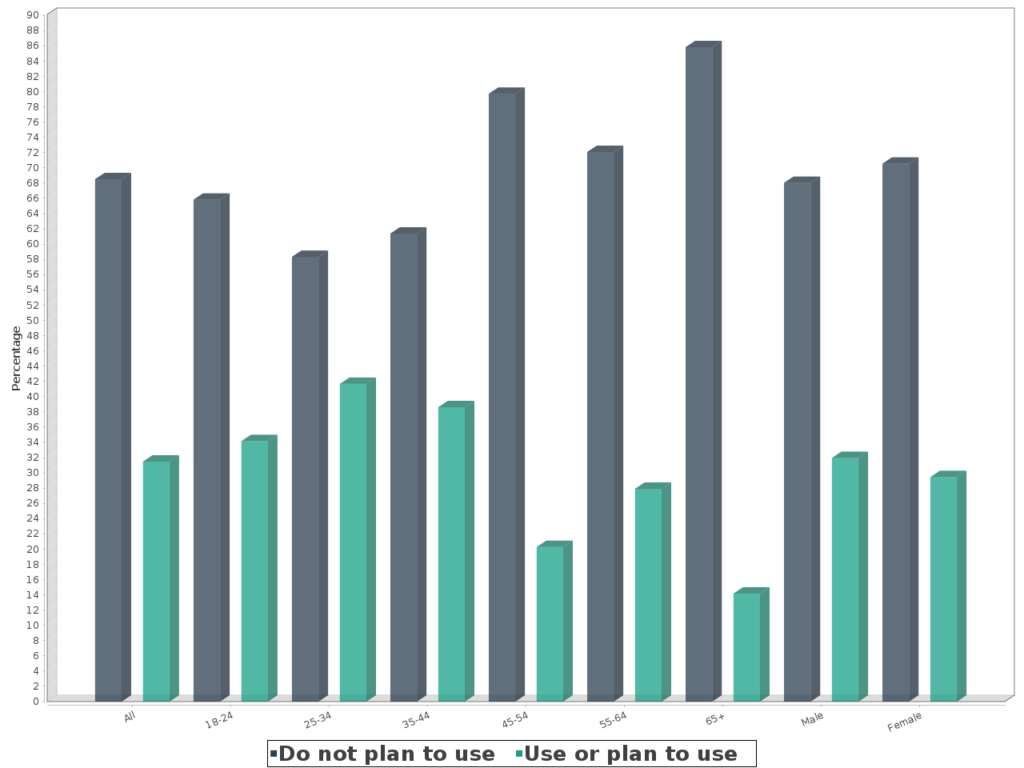

Almost one in three respondents (31%) either already use cryptocurrencies or plan to do so, with 13% indicating they regard them as the future of currency. With such high levels of use there have been predictions of cryptocurrencies overtaking cash as the payment method of choice in the informal economy, while Bitcoin and other cryptocurrencies are becoming a more popular form of payment for goods and services even amongst established businesses.

An often stated criticism is that cryptocurrencies lack intrinsic value, although the same can be said of any ‘fiat money’ such as most national currencies in use today. Some of the more extreme critics even argue that cryptocurrencies are effectively equivalent to pyramid schemes, which would imply that existing investors were only making money due to inflows from new investors, which is inaccurate in that most popular cryptocurrencies are openly traded. A fairer criticism stated by many critics is that investors are seeing the value of their holdings increase due to the effects of a classic investment bubble, in which the prices have been driven up by a vicious circle of demand increasing prices which in turn increases demand.

While blockchain technology allows for transactions to be securely recorded and verified without the need for a centralised authority such as a bank or government, the most popular mechanism for this (as used by Bitcoin) carries a heavy price in the form of energy use. According to the University of Cambridge Centre for Alternative Finance, Bitcoin is now using an amount of electricity approximately equal to the entire country of Sweden. That said it should be pointed out that in most cases, the Bitcoin mining farms responsible for most of this energy usage do wait for electricity prices to be at their lowest. This means they’re often consuming unused capacity from ‘always on’ sources, namely nuclear energy and renewables, so the carbon impact will be less than the energy consumption alone would suggest.

Other findings from the study were that more men than women are currently using cryptocurrencies and that men are more likely to believe cryptocurrencies are ‘the future’, however a larger proportion of women had a plan to try them, meaning that the proportion of female respondents using or planning to use cryptocurrencies was almost a third, as it was with male respondents. Of those who did not intend to use cryptocurrencies, men were more likely to cite fear of outright scams as a reason to avoid them, whereas women were more likely to cite a lack of confidence in cryptocurrencies in general as a reason to avoid them.

The youngest cohort (those under 25) were less enthusiastic than those aged 25 to 44, with those aged 45-54 much more sceptical, enthusiasm increased again amongst the 55-64 age group, with over 65s very reluctant to get involved. Multiple factors at play could explain the way enthusiasm for cryptocurrencies varies across the age cohorts, such as the under 25s being the most concerned about the environment (and thus put off by the energy consumption), those under 45 being less risk averse and more trusting of new technology, resulting in a sweet spot for enthusiasm among those 25-44. The other peak of enthusiasm amongst those over 55 but below retirement age could be explained by that cohort having the most money available to invest but limited options that provide high returns, causing more of them to speculatively invest in cryptocurrencies.