The Abu Dhabi government services ecosystem, TAMM, has added PayBy to facilitate contactless payment for government services through its strategic partner First Abu Dhabi Bank (FAB). The partnership between innovative fintech company PayBy and TAMM will simplify digital payment mechanisms for customers in the Emirate of Abu Dhabi. TAMM aims to consolidate Abu Dhabi government services into a more efficient and easier-to-navigate experience that provides end-to-end journeys on one platform.

With thisnew addition on the Abu Dhabi Pay platform, residents and citizens can use PayBywhen completing digital governmentservices transactions through TAMM, the integrated Abu Dhabi government services platform. This is a part of the continued efforts to provide seamless and secure payment methods and tools to pay fees forgovernment services in Abu Dhabi.

Using Abu Dhabi Pay, customers canconduct government-related transactions viamultiple channels; TAMM portal (tamm.abudhabi), application and POS,eliminatingthe need for physical visits, thus helping safeguard public health and savingtime. PayBy enables the Abu Dhabi community to make online paymentswithout needing credit or debit cards, thus supporting the Abu Dhabi Government agenda to accelerate digital transformation.

Dr Ahmed Khaled Al Hashimi, Director of Digital Literacy Department – Abu Dhabi Digital Authority said: “The addition of PayBy to the Abu Dhabi Pay platform is a significant step forward to achieving our main goal, which is to ensure that all governmentservices and transactions are available to all residents and citizens, digitally, easily and conveniently. We are achieving this through continuous cooperation and coordination with government entities and private sector organisations to implement modern digital technologies and solutions through multiple platforms. Abu Dhabi Payprovidesgreater convenience for everyone throughout the emirate.”

Dr Ahmed added, “Digital transformation in Abu Dhabi is accelerating on a daily basis, and cashless payments are an integral part of our strategy for the future. Having PayBy on board adds another level of accessibility and comfort for users. The partnership between PayBy and ADDA, facilitated by FAB, not only delivers more contactless payment methods for all sections of society, using newest technologies across multiple platforms, it also supports the digital agenda of the Abu Dhabi government.”

Ramana Kumar, EVP and Head of Payments and Digital Banking, PBG, FAB, said:“The UAE’s proactive preventive measures during the pandemic, including early detection and implementing social distancing protocols, served to protect the community’shealth and safety. The FAB-facilitatedpartnership between ADDA and PayBy is another step that offers additional value to our customers, while advancing national goals of public health and financial inclusion.”

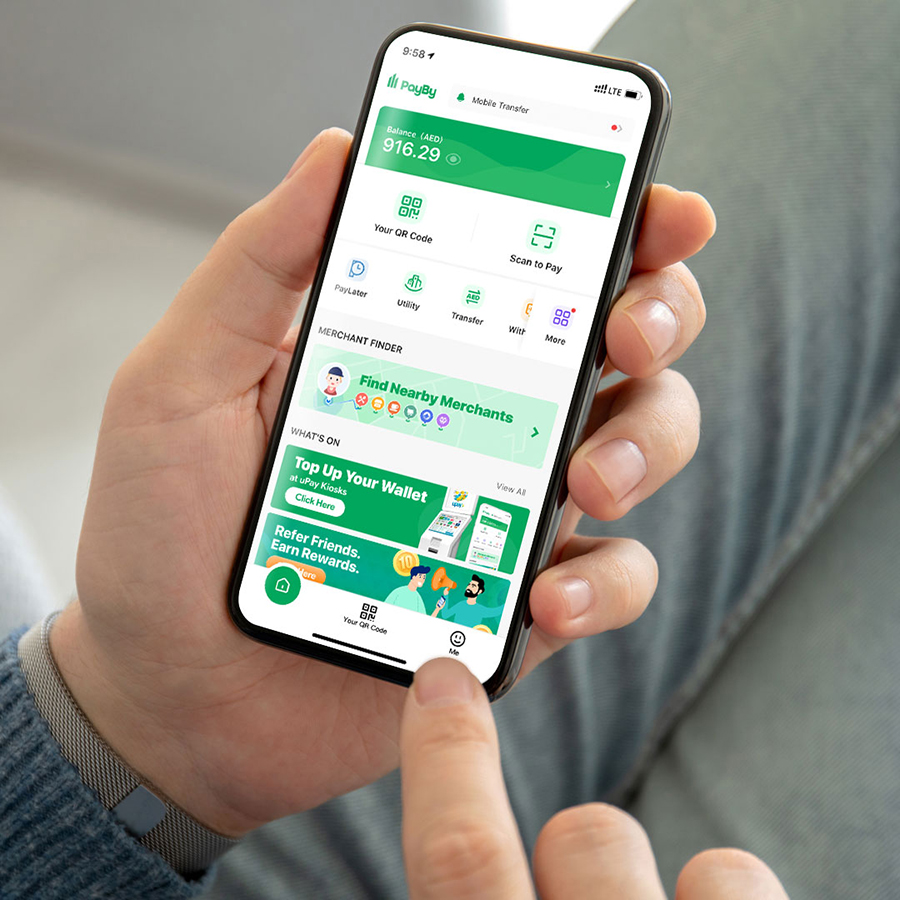

While facilitating digital payments for government services and transactions, PayBy has also helped citizens and residents navigate the pandemic, including those who traditionally use cash for transactions due to a lack of access to credit and debit cards or digital payments. Using the PayBy app, even they can conduct cashless transactions. As smartphone penetration in the UAE is one of the highest in the world at 91 percent, PayBy is actively supporting the ongoing transition to a cashless society, in line with the UAE’s Vision 2021.Customers simply present the QR code in the PayBy app to the service person to scan, and wait for payment confirmation – making for a quick, contactless transaction. For online transactions, PayBy eliminates the need to save or type in credit card details, wait for a one-time password (OTP) and then also the verification code. Users can simply choose PayBy as the payment method when they check out online. A QR code will be displayed on the screen. Users can scan and pay, using the PayBy app on their mobile phones.